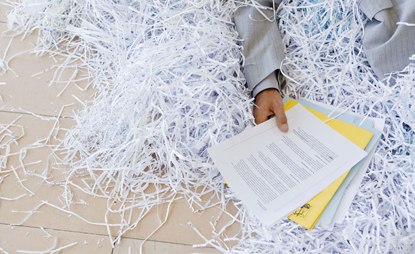

Document Shredding Companies

Document it’s essential not to overlook the importance of securely disposing of physical documents. This is where document shredding companies come in. We SASCO Document Shredding Company offer professional shredding services to ensure that your confidential documents are destroyed securely, protecting your sensitive information from falling into the wrong hands.

Despite the wealth of data our computers store, businesses still produce an enormous volume of paper. This paper ends up in desk drawers, filing cabinets, and storage boxes, eventually cluttering the office and creating a disorganized workspace. We often want to get rid of excess paper documents but feel compelled to ask the question “What if I need this paper again someday?”

Legally businesses are obligated to maintain certain records for specified amounts of time, but holding onto unnecessary documents poses not only a security risk but exposes the business to additional liability. The longer unneeded documents are kept on-site, the more likely they are to potentially wind up in the wrong hands. Which makes determining what to keep and what to destroy a very important question.

Most large organizations maintain a ‘Document Retention Policy’ to help guide the decision-making process when it comes to the storage or destruction of paper records. Retention policies outline the types of records, the retention schedules, and how and when to shred those records. Document Retention and Destruction Policies are based on the legal requirements for organizations to maintain certain documents and records prior to destruction. The policies are designed to mitigate the risk of disposing records too early or holding on to records for too long.

If your organization does not have a ‘Document Retention Policy’ or if you’re unsure which documents to keep and which to send to the shredder, follow this guide to make sure you always have the most important documents on file while keeping your data safe and your office organized.

Documents to Keep (For Now)

There are a few documents you should keep forever—birth certificates, Social Security cards, trademarks—but many should eventually be shredded.

Tax documents: Generally, keep these for seven years before shredding. While the IRS normally has three years to audit you, it has up to seven years under certain situations. The Federal Trade Commission (FTC) has an itemized list of what to do with different kinds of tax records. If you are unsure of what tax records to keep, consult with an accountant or call IRS Taxpayer Assistance.

Employee onboarding files (W-4 and I-9s): Hold on to these for four years after an employee leaves your organization.

Contracts and legal documents: Maintain all legal correspondence. Only shred former client contracts seven years after they end.

Bank statements, pay stubs, and medical bills: Shred them after one year unless you have an unresolved dispute with one of these vendors.

Contact Us On Call or WhatsApp: +91 9820020714

You can also contact us on this site : papershredders.co.in